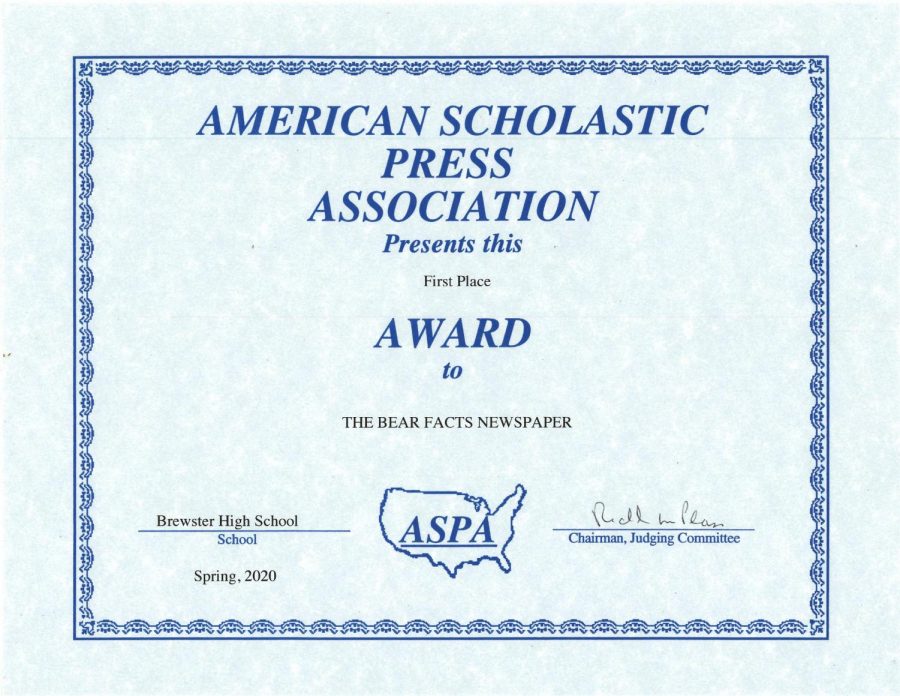

A Farewell from Our Financial Stock Guru

His advise: Expertise is gained through trial and error

June 14, 2022

Before I give my farewell to the wonderful world of Bear Facts, let’s get the market news out of the way. If you’ve been following along with the last two installments, it would be no surprise if I told you the market has been struggling recently. Inflation has been pressuring America as it suffers from the aftermath of a worldwide pandemic, causing investors to worry about their assets. As we’ve learned, panic is the stock market’s biggest enemy, and we’ve seen a loss of almost 15% since the peak of 2022 in March. What does this mean for the future though?

Well, unfortunately, there are practically no signs pointing to any sort of recovery in the near future, with some professionals even saying we are headed towards recession. Stocks will most likely continue to fall, but this isn’t all that bad. As long as the market itself survives, which it will, a recession is an incredible opportunity to invest. The market will most likely see a decline similar to the COVID pandemic, albeit much less aggressive. This means that holding your cash now and buying in soon will give you a great discount on your favorite companies with the hopes of a market recovery within six to twelve month after the total bottom. My best advice (which I’m technically not legally allowed to give) would be to hold some cash aside and wait for news of financial recovery within the next few months. This red period seems like it’s gonna be something that lasts a while so just hang tight.

Now, as my time in high school comes to an end, unfortunately my time writing for the newspaper will come with it. However, there are plenty of things I want anyone out there reading to at the very least think about as I’m writing my last piece.

I realized while giving my senior Ted Talk that I’ve never really explained myself. I’m known as an “expert” by the newspaper but I’ve never really shown why. Of course I say a lot of buzzwords and I use a lot of evidence but I’m sure everyone’s wondering, “What happened to my money?” Well, in short, a quick quote from my Ted Talk, “Unfortunately 800 turned to 9, 9 turned to 1000, 1000 to 1500 and before I knew it I had 3000.” Within a month I more than tripled my money, which some would say is great. However I got in over my head and blew it all quick. This is a valuable lesson in itself, because no matter how much I think I know, I still lost my money. But, some parting information nonetheless.

First off, I realized yesterday while talking to one of my teachers that money shouldn’t be a priority as a student. Of course I’ve preached about how time is on your side and compounding your money will give you amazing results. However, this whole investing thing can be stressful. If you’re even considering starting, you’re way ahead of the curve already, so start off slow and always make sure it doesn’t impact the work you do in your daily life.

My second and probably biggest piece of advice is to learn from your own experience. Reading and watching videos can grant you an incredible amount of information, and it’s how I started too, but eventually you’re going to have to trade yourself. The best way to do this is of course with fake money, or something called a “paper trading” account. My favorite platform for this is ThinkorSwim by TDAmeritrade, but there are a few others out there that work just as well. Like any other skill, practice makes perfect, so definitely don’t rush into throwing away your actual money.

My last piece of advice is to find a group to invest with. I know it sounds like a boring time talking about finance with your friends, but there is nothing better than watching a group of your friends all make money with you. A trading group can keep everyone in check emotionally and allow for everyone to cross examine each other. Beginning anything with a group of people is always helpful and trading is no different.

With that, I again want to quote myself, “You’re all still young, you still have time, you’re just like me, so I just want at least one of you to take this journey with me. Thank you.”