Stock Market Drama Comes in the Form of Redditors

How a group of internet geeks took down the Goliath of hedge fund managers

WALL STREET– the stock market has taken an interesting turn in recent weeks, with hedge funds losing money by the score, market manipulation being thrown around, and the average citizen investing money into stock trading. With the latest short squeeze on these hedge funds, power has shifted in favor of the lower class and away from Wall Street (which is defined as investors, hedge funds, brokers and other businesses whose sole source of income is the trading of stocks).

But what is a “short squeeze”? To understand, a “short” must first be understood.

So, let’s start with a basic definition of a stock. A stock is a share of a company. If a company is worth $100 and a person owns $40 worth of those shares, they own 40% of the company. Companies can make money off of people buying shares from them: a share is directly connected to a company’s worth. The better the company is performing, the higher the price of the share. Companies performing well have shares in higher demand.

Now that a stock has been established, let’s get into shorting. Say an investment banker, who is someone who owns a lot of shares in different companies (let’s call him Bill), owns $100 worth of shares in Company A. A hedge fund manager (we’ll call him Tom), with a hedge fund, which is a fund with a lot of money that makes money off of the trade of shares, thinks that this company is worth more than it actually is. So Tom goes to Bill and says, “I’ll borrow your share on Company A for $2 for 2 months.” Bill agrees. Tom then takes this share and turns to Sam, an ordinary person who is just involved in trading stock. Tom says to Sam, “Hey, you want to buy $100 worth of stock in Company A?” Sam agrees.

2 months pass. Bill calls Tom and says, “I need my share back.” Tom turns to Sam (or any other Joe Schmoe on the market) and says, “Hey, I need to buy that stock back.” If Tom hedged his bets correctly, and Company A was overvalued, then this share should cost less: we’ll say $90. So Tom buys the share back for $90. Tom gives the share back to Bill, and Tom made $8 off of stock trading. This is called shorting.

Now shorting, in and of itself, is not necessarily bad. It’s a good check on the market to ensure that overvalued companies don’t become artificially inflated. However, hedge funds have worked together to short companies, companies that might not be overvalued. They essentially tanked companies for their own profits. This practice, and the fact that hedge funds create no value, gets ordinary citizens mad at them.

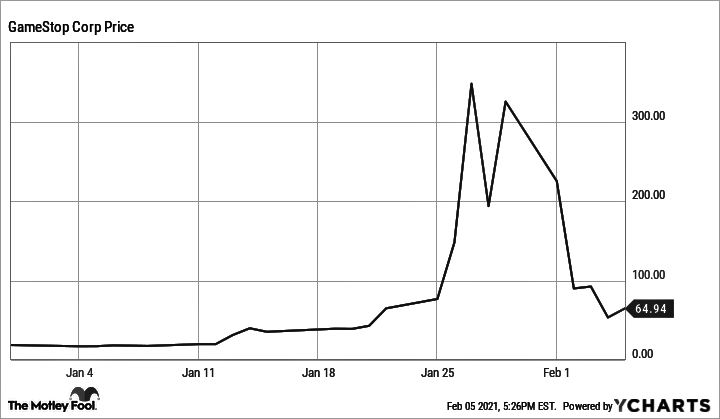

Enter Gamestop. On the subreddit market discussion forum r/WallStreetBets, a user noticed a hedge fund shorting Gamestop. Somehow, this user convinced every active member of the subreddit to engage in a short squeeze. Essentially, these guys just started buying Gamestop shares by the score and trading it with each other. When stock is traded in this fashion, stock prices increase dramatically via supply and demand.

Now, let’s go back to the example from before. Bill lent Tom his share, and Tom sold it to Sam. Now, Bill wants his Gamestop share back. Tom turns to Sam and goes, “Oh no.” Instead of going down, the share price has actually gone up. Now, the stock costs $150, not $100. Tom has to buy these stocks back at an elevated price and lose money in the process. This is called a short squeeze.

Redditors did just this. They artificially elevated the price of the stock so much so that hedge funds have almost gone out of business. They then continued with the movie theater chain AMC and even artificially inflated the price of Dogecoin, a cryptocurrency.

The problem with this action is that Gamestop is not actually worth this much. These actions make Gamestop seem a whole lot healthier than it is. This time period is known as a bubble, and bubbles eventually pop, bankrupting those invested in it at the time.

However, Redditors just wish to stick it to the hedge funds. So now they are saying, “Hold the line.” The longer they hold onto these stocks, the more the price goes up, the more hedge funds hurt, and the more dramatic the squeeze becomes. Eventually, the stock will plummet, and all the money invested will disappear, for the reward of hurting hedge funds.

Wall street has called this practice “Market Manipulation.” Regular people say this is “smart,” but the jury is not yet out on how this saga will end. Look out for updates to this developing issue, and keep these lessons in mind when you invest your own money.